By Anna Leah Gonzales | Philippine News Agency

The Anti-Money Laundering Council (AMLC) has launched a probe into the alleged money laundering of the ransom money paid relating to the kidnapping of businessman Anson Que.

In a statement on Monday, May 12, AMLC said it is working closely with the Philippine National Police (PNP), the Philippine Amusement and Gaming Corp. (PAGCOR), and the casinos on the case.

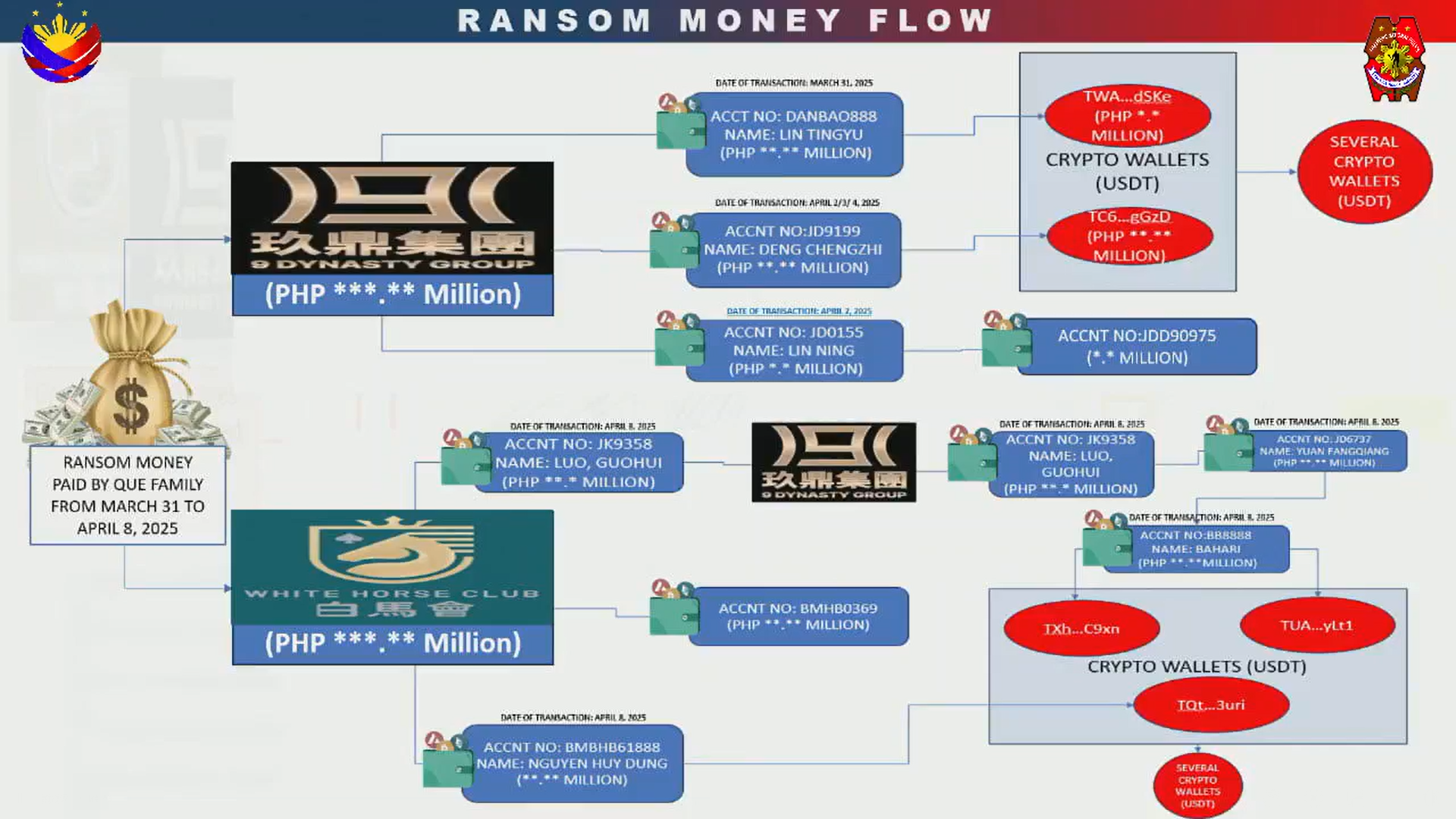

It said the ransom monies were originally paid in Philippine peso and US dollars but were later converted to cryptocurrency.

The PNP alleged that junket operators 9 Dynasty Group and White Horse Club facilitated a money laundering operation involving approximately P200 million ransom paid for Que’s release.

The AMLC said the illicit scheme reportedly used e-wallets intended exclusively for casino gaming, shell accounts, and cryptocurrency to obscure the money trail.

The AMLC received reports that 9 Dynasty Group and White Horse Club officially ended their junket operations in most, if not all, Philippine casinos on May 7, alongside 9 Dynasty’s reported announcement of its exit from the Philippine market.

According to the AMLC, it is collaborating with the PNP to gather evidence on the unlawful activities, tracing the ransom funds in all their forms, and pursuing forfeiture proceedings.

“The investigation extends beyond the kidnappers who directed the ransom payment process. It also targets casino players within these junket operations who initially received the ransom funds via their e-wallets,” it said.

It is also coordinating with the Bangko Sentral ng Pilipinas and the Securities and Exchange Commission for the unlicensed operations of junket operators of e-wallets with cryptocurrency conversion capabilities.

The AMLC is also coordinating with foreign financial intelligence units to gather more information on the movement of funds from the Philippines, saying “Through this ongoing investigation, the AMLC reaffirms its dedication to upholding financial integrity, supporting the immediate resolution of this case, and ensuring that the Philippine financial system does not become a conduit for illicit activities.” (PNA)