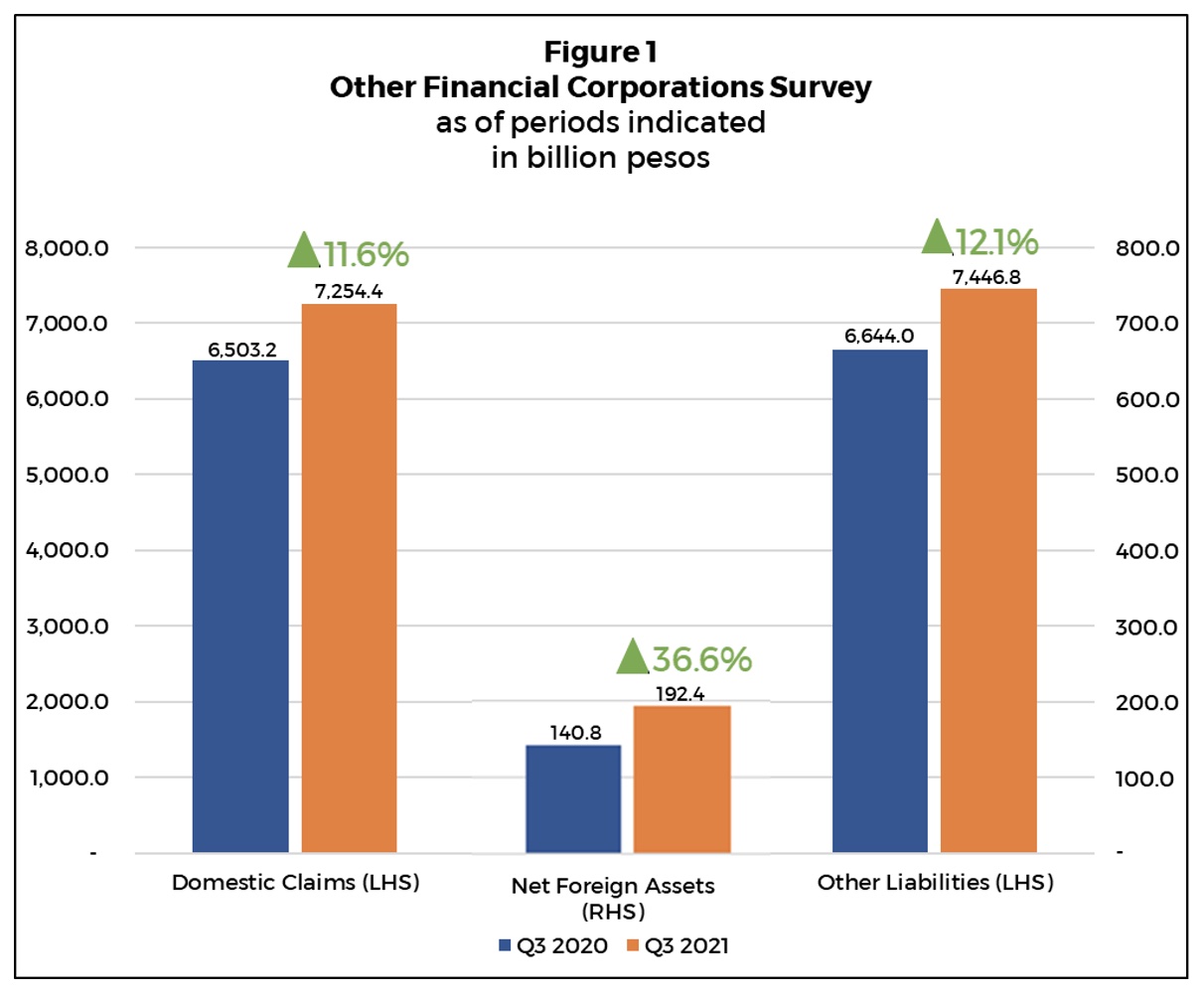

Based on preliminary data on the Other Financial Corporations Survey (OFCS), the domestic claims of the OFCs grew by 11.6% in Q3 2021 to P7,254.4 billion from P6,503.2 billion in Q3 2020.

This increase was primarily attributed to the higher claims on the private sector, which expanded by 22.7% in Q3 2021 to P3,935.6 billion from P3,207.9 billion in Q3 2020, owing to OFCs’ higher investments in equity securities issued by private non-financial corporations and loans extended to households.

In addition, claims on depository corporations inched up by 0.8% from P1,638.6 billion in Q3 2020 to P1,652.5 billion in Q3 2021 on account of higher investments in bank-issued equity securities and increased deposits in banks. Net claims on the central government also increased, albeit marginally, by 0.5% to P1,648.7 billion in Q3 2021 from P1,640.8 billion in the same period last year.

This was largely due to the rise in the sector’s holdings of debt securities issued by the National Government.

Meanwhile, the net foreign assets (NFA) of the OFCs grew by 36.6% from P140.8 billion in Q3 2020 to P192.4 billion in Q3 2021. The growth was driven by higher claims of OFCs on nonresidents, which were mostly in the form of investments in debt and equity securities.

The increase in the OFCs’ assets was funded mainly by the sector’s issuances of shares and other equity. The upturn in equity and insurance technical reserves (ITR), resulted in a 12.1% rise in the other liabilities of OFCs, amounting to P7,446.8 billion in Q3 2021 from the P6,644 billion in Q3 2020. (BSP) – bny