By Dean Aubrey Caratiquet

Investments serve as the lifeblood of a successful and progressive nation, paving the way for an economy that adopts to the ebb and flow of commerce and ensuring a secure foundation for the future of its citizens.

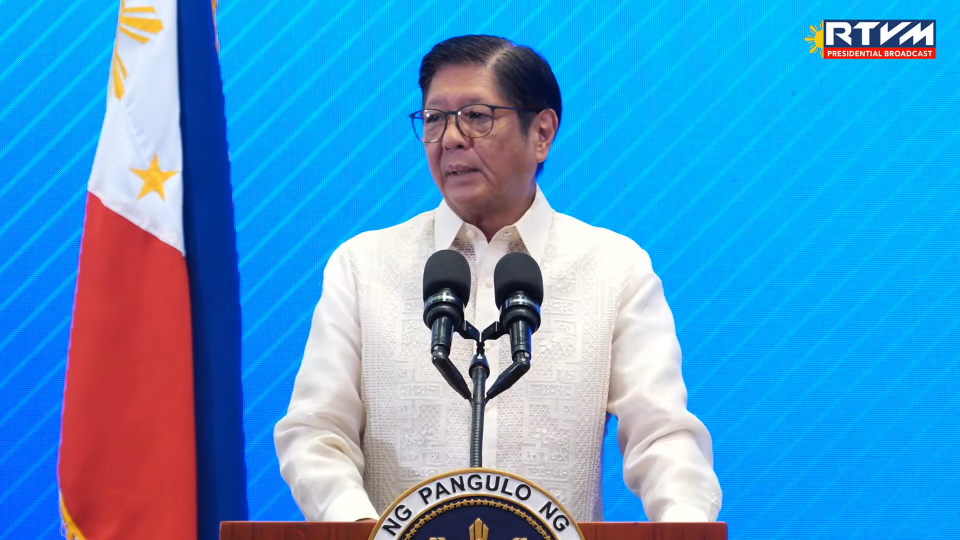

President Ferdinand R. Marcos Jr. has reaffirmed his administration’s commitment towards uplifting the country’s economy, as he aspires for a brighter future for Filipinos under his vision of “Bagong Pilipinas.”

In his speech at a bell-ringing ceremony held at Bonifacio Global City, Taguig City this Tuesday, July 1, President Marcos discussed the salient features of the Republic Act (R.A.) No. 12214, also known as the Capital Markets Efficiency Promotion Act (CMEPA), which he signed into law in May.

The Chief Executive cited the timeliness of CMEPA as a tax reform that “redefines and transforms how Filipinos invest, build, and grow their hard-earned savings.”

Among the features of R.A. 12214 includes a significant reduction in taxes imposed on stock investments—from 0.6% to 0.1%—which will entice more Filipinos to invest in the country’s capital market.

President Marcos said, “This law also removed the documentary stamp tax on mutual funds and unit investment trust funds—investment tools widely used by young professionals and middle-class savers. The adjustment on rates lowers barriers and opens the market to more investors.”

He also announced the introduction of a uniform final tax rate of 20% on interest income, which was enabled by CMEPA, as well as an incentive for companies that help employees save for their retirement.

The President said, “Private employers that match or exceed their workers’ contributions to the Personal Equity and Retirement Accounts (PERA), are now entitled to an additional 50 percent tax deduction on their actual contributions.”

He added, “And at the same time, CMEPA removed certain exemptions to enhance fairness in our tax system. Government-Owned or Controlled Corporations (GOCCs) are now generally subject to the same passive income taxes as other institutions.”

A robust financial system in the making

The CMEPA is set to become a game-changer as it enables Filipinos to participate and invest in the country’s growth, with an expected net revenue of over P25 billion—a substantial sum that can help fund the building of roads, bridges, hospitals, schools, other social safety net programs as well.

In the aspect of business, R.A. 12214 is geared towards building trust in potential investors, reassuring them that the country’s financial system is becoming more equitable and structured for long-term stability.

President Marcos declared, “So, let me be clear: The reform is not just for the well-off and for the professionals, for the stock traders. It is for every Filipino who dreams of better financial security.It empowers the small business owner, the young professional, and the overseas Filipino worker to start investing their hard-earned money to build a better future.”

He added, “Para sa bawat Pilipino, ito po ang layunin ng pamahalaan: Alisin ang mga balakid at palawakin ang mga oportunidad para sa ating pag-unlad. Indeed, this Act allows Filipinos to be true participants in our nation’s economic growth.”

The Chief Executive cited the CMEPA as pivotal in boosting the country’s competitiveness in the Association of Southeast Asian Nations (ASEAN) region, paving the way for a capital market that can keep pace with the flow of commerce on the global stage.

Moreover, he also directed the Securities and Exchange Commission (SEC) to streamline its procedures, reduce transaction costs within its control, and quash bureaucratic bottlenecks to facilitate productive engagements with its clientele, especially in these changing times.

av