By Brian Campued

The recent directive of President Ferdinand R. Marcos Jr. to reduce interest rates for salary and calamity loans offered by the Social Security System (SSS) is aimed at easing the financial burden of Filipinos and help curb poverty, Malacañang said Friday.

“Kapag po nalaman natin na iyong interest po ay bababa para sa mga kababayan natin na may kasalukuyang utang sa SSS, maganda pong balita iyan. Para po kahit po iyong kanilang kinikita o ang kanilang kaunting savings para maibayad, mababawasan iyong kanilang pagbabayad sa kanilang mga utang dahil liliit po ang interest,” Palace Press Officer and Presidential Communications Office Undersecretary Claire Castro said in a press briefing.

“So, iyon po iyong nais ng ating Pangulo at ito’y po para sa taumbayan, para po kahit papaano ay maibsan ang kanilang kahirapan o nararamdamang kahirapan sa kasalukuyan,” Castro added.

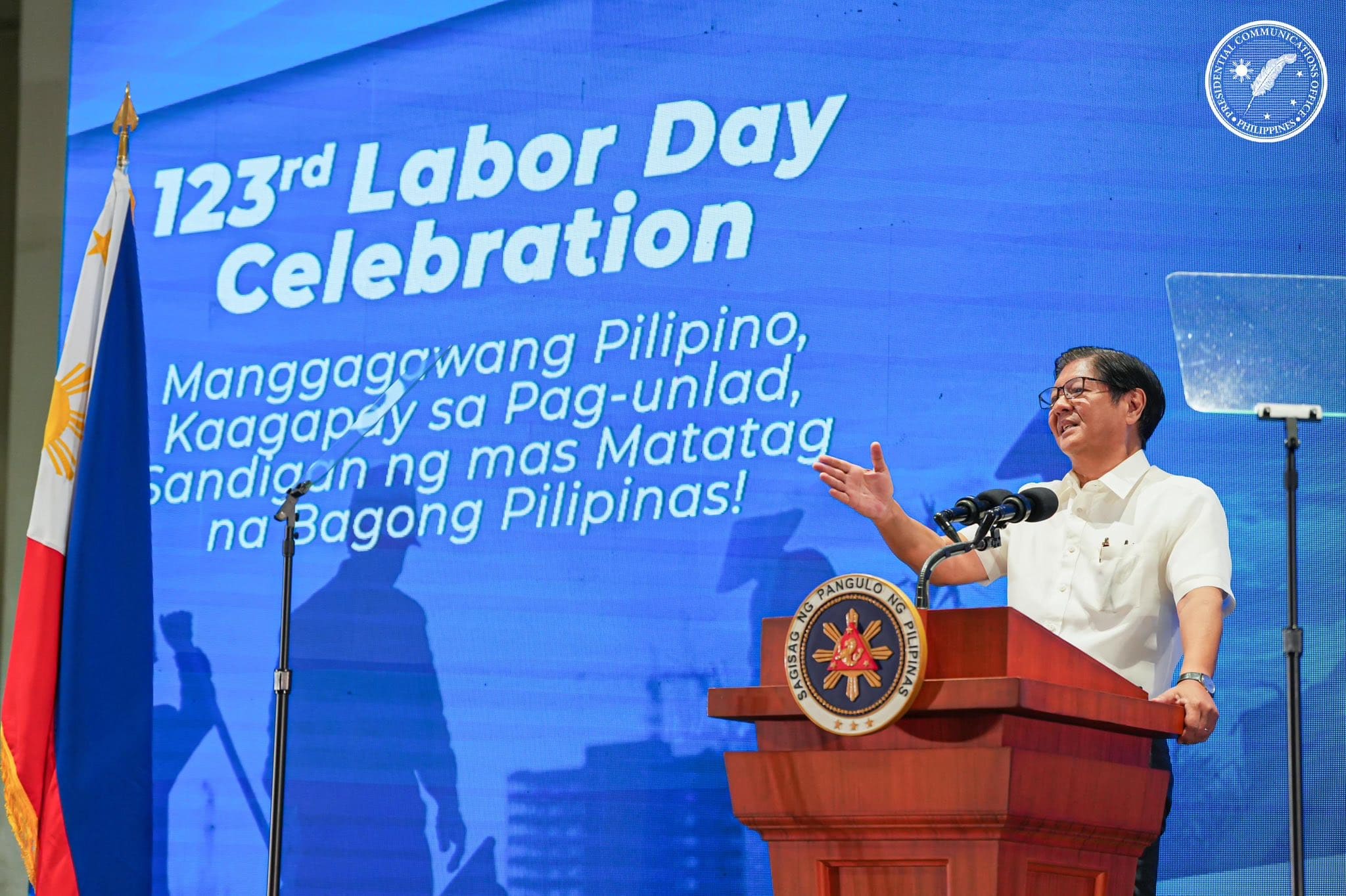

In his Labor Day message in Pasay City on Thursday, the President announced that SSS members who have no availment of penalty condonation in the past five years or those who have good credit quality would be eligible for interest rate cuts starting July 2025.

“Ang mga miyembro na may malilinis na record ay makakakuha ng loans sa SSS sa mas mababang interes. Bababa po sa walong porsyento ang interest rate para sa salary loans at pitong porsyento naman para sa calamity loans. Bumaba po ang mga rates na ito mula sa dating 10 porsiyento,” Marcos explained.

Enhancing other loan programs, services

The SSS is also eyeing the expansion of its Pension Loan Program (PLP) to include surviving spouse pensioners beginning September 2025. The maximum loanable amount shall be P150,000.00.

“We acknowledge the need of other pensioners for access to a dependable loan facility, so we are expanding the PLP to surviving spouse pensioners,” SSS President and Chief Executive Officer Robert Joseph de Claro said in a statement.

Moreover, the PLP for surviving spouse pensioners shall also be covered by Credit Life Insurance, with the insurance premium to be deducted from the proceeds of the Pension Loan (PL). This is to ensure that in the event of the death of the PL borrower before full payment and end of the loan term, the PL balance shall be fully paid.

The SSS is also looking at ways on how to help its members through livelihood loans as part of the administration’s efforts on poverty alleviation.

The agency is also in talks with the Department of Information and Communications Technology (DICT) on digitalization programs, with the Philippine Health Insurance Corp. (PhilHealth) for better collaboration through data synchronization, and with other industries for targeted stakeholder engagements.

De Claro added that the SSS has also started discussions with partner financial institutions on the feasibility of implementing a micro credit loan facility for members with a tenor between 15–90 days.

“We offer these enhancements to all Filipino workers, here and overseas… We remain committed to our push for service excellence with program enhancements and innovations,” De Claro said.

-iro