By Agence France-Presse

Top officials from the United States and China said on Tuesday, June 10, that they had agreed on a “framework” to move forward on trade, following two days of high-level talks in London to resolve tensions.

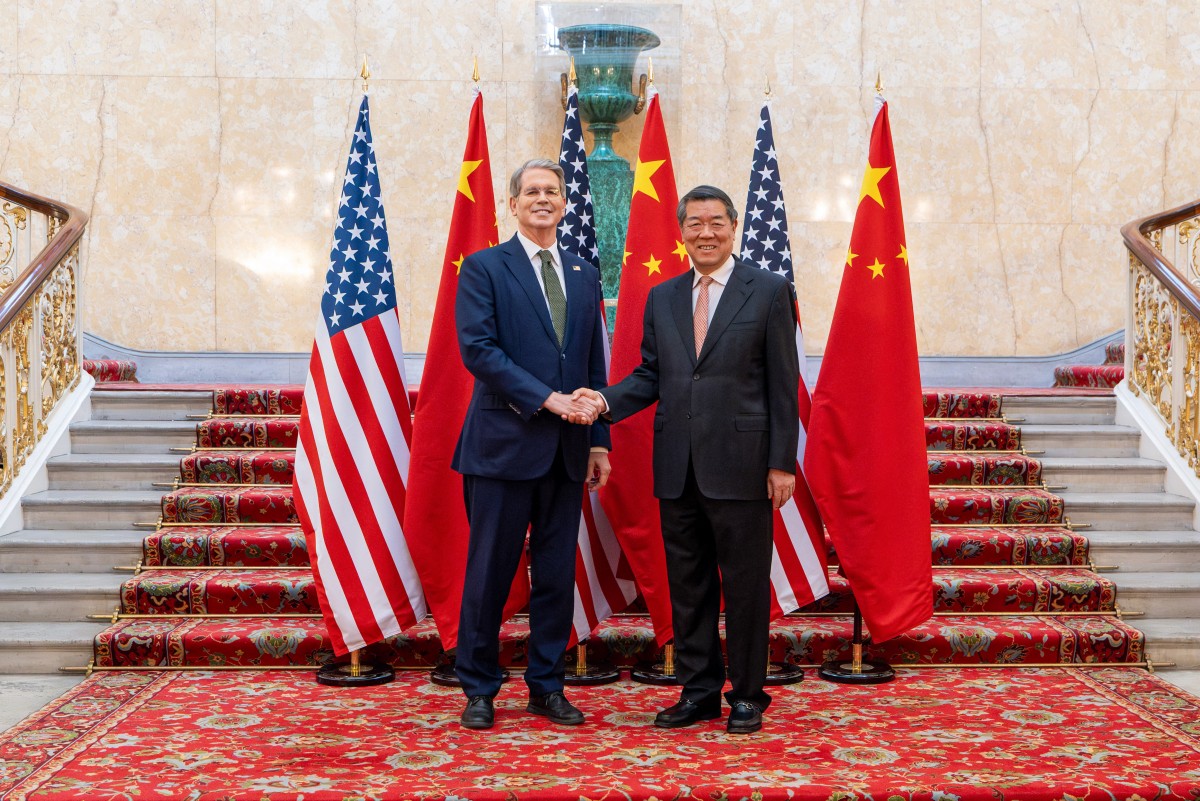

U.S. Commerce Secretary Howard Lutnick expressed optimism after a full day of negotiations that concerns surrounding rare earth minerals and magnets “will be resolved” eventually, as the deal is implemented.

But this framework will first need to be approved by leaders in Washington and Beijing, officials said, at the end of meetings at the British capital’s historic Lancaster House.

All eyes were on the outcomes of negotiations as both sides tried to overcome an impasse over export restrictions. Earlier, U.S. officials accused Beijing of slow-walking approvals for shipments of rare earths.

The world’s two biggest economies were also seeking a longer-lasting truce in their escalating tariffs war, with levies briefly put on hold.

U.S. Trade Representative Jamieson Greer told reporters, “We’re moving as quickly as we can. We would very much like to find an agreement that makes sense for both countries.”

He maintained: “We feel positive about engaging with the Chinese.”

Speaking separately to reporters, China International Trade Representative Li Chenggang said: “Our communication has been very professional, rational, in-depth, and candid.”

Li expressed hope that progress made in London would help to boost trust on both sides.

Productive talks

Earlier, U.S. Treasury Secretary Scott Bessent described the closely-watched trade talks as productive, although scheduling conflicts prompted his departure from London with negotiations still ongoing.

Bessent, who led the U.S. delegation with Lutnick and Greer, left early to return to Washington for testimony before Congress, a U.S. official told AFP.

Chinese Vice Premier He Lifeng headed his country’s team in London, which included Li and Commerce Minister Wang Wentao.

Both sides do not yet have another gathering scheduled. But Lutnick said on Tuesday, June 10, that U.S. measures imposed when rare earths “were not coming” would likely be relaxed once Beijing moved forward with more license approvals.

Global stock markets were on edge, but Wall Street’s major indexes climbed on hopes for progress earlier on Tuesday.

The London negotiations follow talks in Geneva last month, which saw a temporary agreement to lower tariffs.

This time, China’s exports of rare earth minerals—used in a range of things including smartphones, electric vehicle batteries, and green technology—were a key issue on the agenda.

U.S. President Donald Trump’s top economic adviser, Kevin Hassett, told CNBC on Monday, June 8: “In Geneva, we had agreed to lower tariffs on them, and they had agreed to release the magnets and rare earths that we need throughout the economy.”

He added, “Even though Beijing was releasing some supplies, “it was going a lot slower than some companies believed was optimal.”

‘Mirror arsenal’

Head of strategy at Minerva Technology Futures, Emily Benson said: “Both countries have developed almost a mirror arsenal of trade and investment weapons that they can aim at each other.”

She told AFP: “As they tap economic tools to try and shift global power structures, it may not be reasonable to expect a typical trade and investment deal.”

But both sides could find ways to level off a downward spiral.

Benson said, noting that Beijing appeared understaffed given the volume of requests: “A dialing-down of temperatures could involve Chinese efforts to shore up the process for granting export control licenses.”

She added: “On the U.S. side, this could look like a relaxation of certain export curbs in the high-tech domain.”

But observers remained cautious, with Thomas Mathews of Capital Economics warning that Washington was unlikely to “back off completely.” This could weigh on markets.

Since returning to office, Trump has given a 10 percent levy on friend and foe, threatening steeper rates on dozens of economies. His tariffs have dented trade, with Beijing data showing that Chinese exports to the United States plunged in May.

On Tuesday, June 10, the World Bank joined other international organizations to slash its 2025 global growth forecast amid trade uncertainty.

China is also in talks with partners including Japan and South Korea to try to build a united front countering Trump’s tariffs.